Sri Lanka Insurance Corporation Limited was incorporated on 3rd February 1993 under the Companies Act No.17 of 1982 bearing No. N(PBS/CGB)/ 159 and re-registered under the Companies Act No.07 of 2007 on 17th April 2008 bearing No. PB 289.

Registered Office

- Sri Lanka Insurance Corporation Ltd.

- No. 21, Vauxhall Street, Colombo 2.

Board of Directors

The Board of Directors as at reporting date is as follows:

- Mr. Nusith Kumaratunga - Chairman / Director

- Mr. Anil Koswatte - Director

- Mr. Sinhalage Aruna Nishantha - Director

- Mr. Dushmantha Thotawatte - Director

- Mr. Kandegamage Ravindra Pathmapriya - Director

Legal Form

Sri Lanka Insurance Corporation Ltd was established under the provisions of Insurance Corporation Act No. 2 of 1961 as a State Owned Corporation. In 1993, the Corporation was converted to a fully government-owned limited liability company of which the sole shareholder of 100 per cent shares was the Secretary to the Treasury, under the Conversion of Public Corporations or Government owned Business Under-takings into Public Companies Act, No. 23 of 1987. Under the privatization programme of the Government, the company was privatized in 2003 and was under the private management for a brief period of six years. The Corporation was re-registered under the companies Act No. 7 of 2007. Pursuant to the Supreme Court Judgment on 04th June 2009, annulling the privatization, 99.97 per cent shares are vested with the Secretary to the Treasury on behalf of the Government of Sri Lanka.

Subsidiaries

Updated details will be available soon

Sub-Subsidiaries

Updated details will be available soon

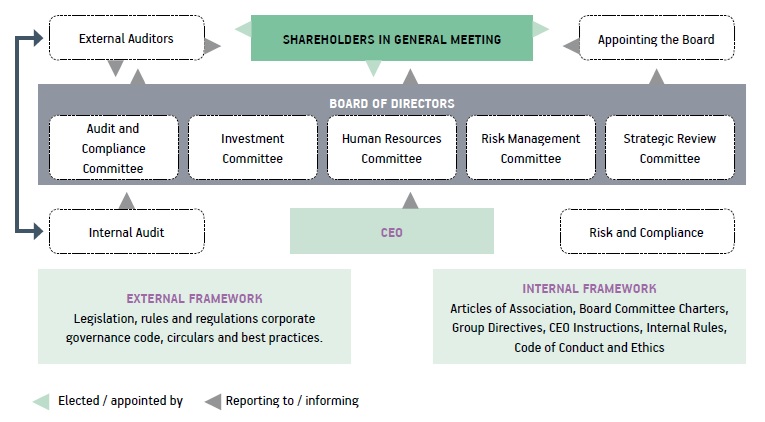

The Company through its Board of Directors and Board sub-committees maintain a governance framework in all areas of its operations including formalized policies, procedures, guidelines and relevant management reporting lines.

Being a State Owned Enterprise (SOE), the Board of Directors acts as an intermediary between the State as the main shareholder, and the Company and its management. The Board is responsible for the overall stewardship and provides leadership both directly and indirectly through the Board sub-committees, to deliver long-term values to the stakeholders. The main role of the Board of Directors is oversight and planning. The Company’s financial and commercial performances are regularly assessed by the Board. In addition, the Board reviews and assesses the adequacy of the management of all risks the Company may be exposed to.

The establishment of Board committees has been instrumental in enhancing the efficiency of the Board and adds value to the Board in the fields of audit, compliance investment, human resource, and risk management etc. To assist the board’s oversight, planning and decision making functions the Board has established four sub-committees: the Audit and Compliance Committee, the Risk Management Committee, the Investment Committee and the Human Resources Committee. The Committees are governed by board approved charters, policies and procedures and report to the Board at periodic board meetings.

In addition to the above mentioned Board Sub-Committees, in order to assist the CEO, other operational committees include Reinsurance Committee, Audit Follow-up Committee, the Branch Management Outlook Committee, the Management Committee, the Legal Committee and the Sales & Marketing Review Committee, all of which play an essential role in the governance structure. Members are drawn from within the company and in accordance with their relevant areas of expertise.

The internal control framework of the company encompasses the policies, procedures, processes, tasks and behaviours. The Company has an internal audit function, which has a reporting line to the Chairman of the Board and the Chairman of the Audit and Compliance (ACC) Committee. The ACC receives reports from this function at each committee meeting. In addition, the Company adopts a holistic view on Enterprise Risk Management (ERM) pertaining to four main risks; namely, strategic, financial, operational and hazard.

The legal framework of SLIC is highly complex as plethora of laws, rules and regulations are applicable. On one hand, SLIC is a limited liability company registered under the Companies Act and accordingly obliged to comply with the Companies Act, No.07 of 2007. Being a limited liability company, we are also obliged to comply with other applicable laws, rules & regulations which include Shop & Office Act, Termination of Employment Act, Inland Revenue Act and Intellectual Property Act etc.

Further, being an insurance Company we are obliged to comply with the Regulation of Insurance Industry Act, No.43 of 2000 as amended. Under the Act, the IRCSL has issued 15 Determinations, 43 circulars, 22 directions and many other rules and regulations. We submit reports to the regulators periodically like quarterly, half yearly and annually. Further, being an insurance company, we are obliged comply with the Prevention of Money laundering laws of the country. In addition, being an insurance Company, we are obliged to comply with the Corporate Governance 2017 issued by the SEC & ICASL.

On the other hand, being a Government entity we are obliged to comply with certain legal requirements like Right to Information Act, Assets and Liability Declaration Act, Official Languages Laws applicable to Public Enterprises based on the Constitution and the relevant certain circulars of the Ministry of Finance etc.

SRI LANKA INSURANCE CORPORATION LTD - RECORDING KEEPING REQUIREMENTS

As per the statutory provisions stipulated in Companies Act, No. 7 of 2007, Financial Transactions Reporting Act, No. 6 of 2006, Value Added Tax Act, No. 14 of 2002 as amended, Economic Service Charge Act, No.13 of 2006 as amended, Regulation of Insurance Industry Act, No. 43 of 2000 and Right to Information Act, No.12 of 2016 the company keeps records and databases in the manner given below;

|

Section/Source |

Requirements |

Responsible Department / Person |

|

Section 116 (1) of the Companies Act, No. 7 of 2007 |

Documents to be Kept Under the Company Secretary The following documents should be kept under the custody of the company secretary for a period of ten years: (a) the certificate of incorporation and the articles of the company, (b) minutes of all meetings and resolutions of shareholders passed within the last ten years, (c) an interests register, unless it is a private company which is dispensed with the need to keep such a register, (d) minutes of all meetings held and resolutions of directors passed and directors’ committees held within the last ten years, (e) certificates required to be given by the directors under the Act within the last ten years, (f) the register of directors and secretaries required to be kept under section 223, (g) copies of all written communications to all shareholders or all holders of the same class of shares during the last ten years, including annual reports prepared under section 166, and (j) the share register required to be kept under section 123. |

Company Secretary |

|

Section 116 (1) of the Companies Act, No. 7 of 2007 |

Documents to be Kept Under the CFO and Department Heads The following documents should be kept under the custody of CFO and department heads for a period of ten years: (h) copies of all financial statements and group financial statements required to be completed under the Act for the last ten completed accounting periods of the company, (i) the copies of instruments creating or evidencing charges and the register of charges required to be kept under sections 109 and 110. |

CFO, AGM (Legal) and Department Heads |

|

Section 148 (1) of the Companies Act, No. 7 of 2007 |

Keeping Accounting Records-CFO Every company shall keep accounting (Section 116 (1)(k): the accounting records required to be kept under section 148 for the current accounting period and for the last ten completed accounting periods of the company) records which correctly record and explain the company’s transactions, and will- (a) at any time enable the financial positions of the company to be determined with reasonable accuracy; (b) enable the directors to prepare financial statements in accordance with the Act; and (c) enable the financial statements of the company to be readily and properly audited. In terms of section 148(2) without limiting the provisions contained in subsection (1) of section 148, the accounting records shall contain- (a) entries of money received and expended each day by the company and the matters in respect of which such money was spent, (b) a record of the assets and liabilities of the company ,(c) if the company’s business involves dealing in goods- (i) a record of goods bought and sold, except goods sold for cash in the ordinary course of carrying on a retail business that identifies both the goods and buyers and sellers and the relevant invoices; (ii) a record of stock held at the end of the financial year together with records of any stock takings during the year; (d) if the company’s business involves providing services, a record of services provided and relevant invoices. |

CFO |

|

Section 4 of Financial Transactions Reporting Act, No. 6 of 2006 |

Keeping Records Pertaining to FIU Records of transactions and of correspondences relating to transactions, records of all reports furnished to the Financial Intelligence Unit (FIU) of the Central Bank of Sri Lanka and records of identity of customers (sufficient to identify name, address, details of the transaction etc.) should be kept for six years, unless the FIU directs otherwise. |

(Life, Risk Management, Finance, Internal Audit, HR and Compliance) |

|

Section 64 of the Value Added Tax Act, No. 14 of 2002 |

Records in Respect of Taxable Activity-VAT Every registered person shall keep and maintain records in respect of the taxable activity carried on or carried out by him to enable the Commissioner-General or any other officer authorised by the Commissioner-General or that behalf to ascertain the liability for the payment of the tax. |

CFO |

|

Section 8 of the Economic Service Charges Act, No. 13 of 2006 |

Keeping Records-ESC Every person and partnership chargeable with the service charge shall maintain a record of the transaction of every trade, business, profession or vocation carried on or exercised by such person or partnership, in such manner as would facilitate the reconciliation of the return of relevant turnover furnished by such person or partnership under section 7 of this Act, with such record. |

CFO |

|

Section 47 of the Regulation of Insurance Industry Act, No. 43 of 2000 (RII Act) |

Keeping Records-RII Act An insurer shall prepare and maintain its accounts in such form and manner as may be determined by the Board by rules made in that behalf. The auditor shall state in its report whether the accounting records of the Insurer have been maintained in the manner required by the rule made by the Board in that behalf, so as to clearly indicate the true and fair view of the financial position of the Insurer. |

CFO |

|

Section 07 of the Right to Information Act, No.12 of 2016 |

Keeping Records-RI Act All records being maintained by every public company shall be preserved – (a) In the case of those records already in existence on the date of coming into operation of this Act, for a period of not less than ten years from the date of coming into operation of the Act; and (b) In the case of new records which are created after the date of coming into operation of this Act, for a period of not less than twelve years from the date on which such record is created. No record or information which is the subject matter of a request made under this Act, shall be destroyed during the pendency of such request or any appeal or judicial proceeding relating to such request. |

Department Heads

|

The company's annual report is available for free on the company's website.

https://www.srilankainsurance.com/en/about-us/annual-reports

Procedure of initiating requests for information

- 1. Requests for Information should be made to the following Information Officer by completing and handing over a request preferably in the manner prescribed in the Form RTI 01 although this is not mandatory.

General Insurance

Ms. Deshani Jayatilake

Designation: Senior Manager - Legal (Litigation)

Address: No. 21, Vauxhall Street, Colombo 02

Contact Number: 011 2357331

Email: deshanij@srilankainsurance.com

Life Insurance

Ms. Manjula Jayathilake

Designation: Senior Manager - Legal (Claims)

Address: No. 21, Vauxhall Street, Colombo 02

Contact Number: 011 2357322

- 2. If the applicant is not satisfied by the decision given by the Information Officer, an appeal can be made to the Designated Officer, subject to the provision in the Right to Information Act 12 of 2016 in situations where

- i) The Information Officer refuses a request made for information

- ii) The Information Officer refuses access to the information on the ground that such information is exempted from being granted under Section 5

- iii) Non -compliance with timeframes specified in the Act

- iv) The Information Officer granted incomplete, misleading or false information

- v) The Information Officer charged excessive fees

- vi) The Information Officer refused to provide information in the form requested

- vii) The citizen making the request had reasonable grounds to believe that information has been deformed, destroyed or misplaced to prevent him/her from having access to the information An appeal to the Designated Officer is to be made within 14 days

Designated Officer

Mr. Chandana L Aluthgama

Designation: Group Chief Executive Officer

Address: Sri Lanka Insurance Corporation Ltd, No. 21, Vauxhall Street, Colombo 02

Contact Number: 0112357357

- 3. When making an appeal to the Designated Officer, the RTI 10 Form is not compulsory. A citizen making a request can make the appeal by a letter with the basic information indicated in RTI 10 justifying the appeal.

Budget, Financial Information/ Actual Income & Expenditure

The Department of Finance is primarily responsible for preparing the preparation of the company's budget with the assistance of other departments.

Please refer to the Financial Reports section comprised in the Company Annual Reports.

https://www.srilankainsurance.com/en/about-us/annual-reports

Audit Reports

The report of the Independent Auditors is included in the Annual Report of the Company. The Auditor General is being functioned as the Company's Auditor.

Executive salary-minimum and maximum – Please click here

Non-Executive salary-minimum and maximum – Please click here

The details of the senior management team is included in the Company’s Annual Report.

https://www.srilankainsurance.com/en/about-us/annual-reports